Personal finance management can be challenging, especially when faced with fluctuating expenses, unexpected costs, and long-term savings goals. One of the simplest and most effective methods for managing your finances is the 50-30-20 budgeting method. This strategy divides your after-tax income into three broad categories—needs, wants, and savings or debt repayment—helping you create a balanced, achievable, and sustainable financial plan.

In this comprehensive guide, we will delve into how the 50-30-20 budgeting method works, why it’s effective, and how you can implement it to improve your personal finance and budgeting practices. Whether you’re trying to save for the future, pay off debt, or simply manage your monthly expenses, this method can serve as a blueprint for better financial health.

What Is the 50-30-20 Budgeting Method?

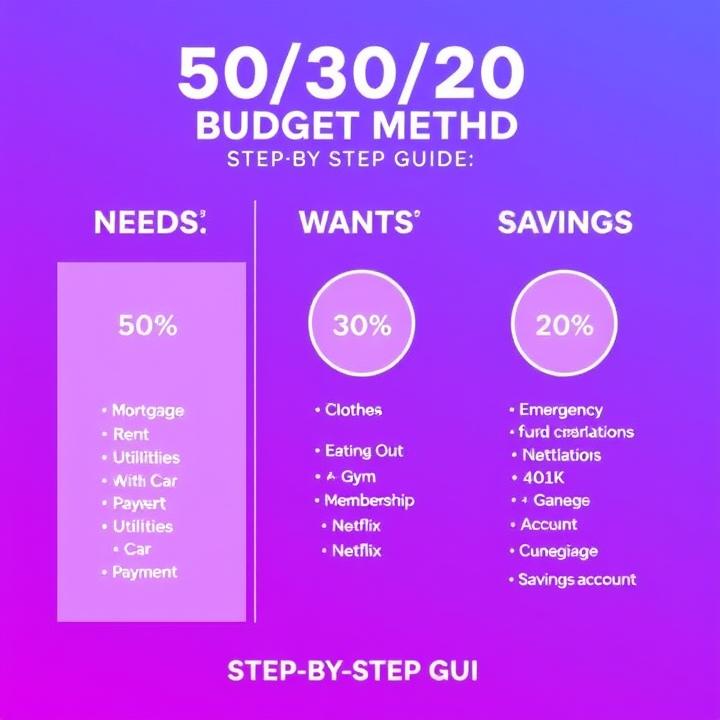

The 50-30-20 budgeting method is a financial rule that divides your income into three distinct categories:

- 50% for Needs

- 30% for Wants

- 20% for Savings and Debt Repayment

This simple division is designed to help you balance your necessary expenses, enjoy life’s pleasures, and still build financial security. Whether you are just starting your budgeting journey or looking for a better way to manage your finances, the 50-30-20 method offers a straightforward structure to follow.

How Does the 50-30-20 Budget Work?

50% for Needs

The 50% for needs portion of the budget is meant for essential expenses—things you need to live. These expenses are non-negotiable, and they include things like:

- Housing Costs: Rent or mortgage payments, property taxes, home insurance.

- Utilities: Gas, electricity, water, internet, phone bills.

- Groceries: Essential food and household items.

- Transportation: Car payments, insurance, fuel, public transit fares.

- Healthcare: Insurance premiums, medical bills, medications.

- Childcare and Education: School fees, daycare, and related expenses.

The idea behind this 50% allocation is that these are basic living expenses that you cannot eliminate entirely. The 50% allocation ensures that these needs are met first, before considering wants or savings.

30% for Wants

The 30% for wants portion of your budget is reserved for discretionary spending—those expenses that enhance your quality of life but are not absolutely necessary. Wants include:

- Dining Out: Restaurants, takeout, coffee shops, bars.

- Entertainment: Movies, concerts, events, streaming subscriptions.

- Vacations and Travel: Flights, hotels, activities.

- Hobbies and Personal Luxuries: Fitness classes, shopping for clothes, gadgets, and other non-essential goods.

- Subscriptions: Streaming services, magazines, online memberships.

While these are important for enjoying life and having experiences, the 30% allocation allows you to indulge in wants while still maintaining control over your finances. Importantly, wants are more flexible than needs, meaning they can be cut back or adjusted without compromising your financial security.

20% for Savings and Debt Repayment

The final 20% of your income is dedicated to savings and debt repayment. This portion is critical for building your financial future and preparing for emergencies. Here’s how you can allocate this portion:

- Emergency Fund: Building a fund for unexpected expenses like medical bills, car repairs, or job loss.

- Retirement Savings: Contributions to retirement accounts such as 401(k)s, IRAs, or pension funds.

- Investments: Buying stocks, bonds, or real estate for long-term wealth growth.

- Debt Repayment: Paying off high-interest debts, student loans, credit card balances, and other loans beyond the minimum required payments.

The 20% allocation ensures that you’re not only focusing on the present but also securing your financial future. It helps reduce financial stress, especially when you face unforeseen events, and promotes long-term wealth creation.

How to Apply the 50-30-20 Budgeting Method

Now that you understand the core components of the 50-30-20 budgeting method, it’s time to put this into practice. Here are the steps to successfully implement the 50 20 30 budgeting method:

Step 1: Calculate Your Take-Home Pay

The first step is to determine your after-tax income—this is the amount of money you take home after all taxes and deductions (like health insurance or retirement contributions) have been taken out. This is the number you’ll use to calculate your budget allocations.

Let’s say you make $3,000 per month after taxes. Your income breakdown using the 50 30 20 budgeting method would look like this:

- 50% for needs: $1,500

- 30% for wants: $900

- 20% for savings and debt repayment: $600

Step 2: Categorize Your Expenses

Review your monthly expenses and categorize them into one of the three areas of your budget:

- Needs: These are your essential expenses. Include rent or mortgage payments, utilities, groceries, transportation, insurance, and minimum debt payments.

- Wants: These are your non-essential expenses. Include dining out, entertainment, travel, hobbies, and subscriptions.

- Savings and Debt: Include any additional payments toward debt (beyond the minimum), contributions to your emergency fund, retirement accounts, and investments.

Step 3: Adjust Your Allocations as Needed

If you find that your essential expenses (needs) are greater than 50% of your income, you may need to adjust the percentages in the other categories. For example, you might allocate more toward savings or cut back on wants. The beauty of the 50-30-20 method is that it’s a flexible guideline that you can tweak to fit your unique situation.

For example, if your rent costs $1,800 per month, which is more than 50% of your income, you might need to reduce your spending in the wants or savings categories temporarily.

Step 4: Track and Review Regularly

Tracking your spending is essential to make sure you’re sticking to your budget. You can use apps like Mint, You Need A Budget (YNAB), or a simple spreadsheet to monitor your expenses. Reviewing your budget regularly will help you identify areas where you might be overspending and make adjustments as needed.

Benefits of the 50-30-20 Budgeting Method

The 50-30-20 budgeting method offers several key advantages:

- Simplicity: The 50-30-20 method is easy to understand and implement. You don’t have to track every small purchase or deal with complex financial tools.

- Balance: This method ensures that you prioritize essential living expenses, enjoy life’s pleasures, and still save for the future.

- Flexibility: The method is adaptable to different financial situations. You can tweak the percentages based on your individual needs and financial goals.

- Financial Security: By allocating money for both debt repayment and savings, the method helps you build a cushion for the future and reduces the impact of financial emergencies.

- Improved Money Management: With a clear understanding of where your money is going, it’s easier to make informed decisions and avoid impulse spending.

Common Pitfalls to Avoid

While the 50-30-20 method is a straightforward budgeting tool, there are several common mistakes people make when applying it:

- Misclassifying Wants as Needs: It’s easy to confuse things like cable TV, new clothes, or dining out with essential needs. However, these are wants, not needs, and should be accounted for in the 30% category.

- Ignoring Debt: The 20% allocated for savings and debt should include more than just savings. Make sure to prioritize paying off high-interest debt in this category to improve your financial health.

- Underestimating Needs: Make sure to account for all of your essential expenses, including irregular ones, like insurance premiums or annual subscriptions.

- Over-Allocating Wants: The 30% for wants might seem tempting to expand, but over-allocating this portion can quickly derail your budget. Enjoying life is important, but don’t let it compromise your financial goals.

Adjusting the 50-30-20 Method for Specific Situations

The 50-30-20 budgeting method is flexible and can be adjusted to fit your personal circumstances. Here’s how you can modify the method for specific needs:

- High Cost of Living: If you live in an area with high rent or other essential costs, your needs category might take up more than 50% of your income. In this case, you can allocate less to wants or savings, but it’s important to still prioritize saving a portion for the future.

- Aggressive Debt Repayment: If you’re focused on getting out of debt quickly, you can allocate a higher percentage (such as 25% or 30%) of your income to debt repayment. Just make sure not to neglect your emergency fund or long-term savings completely.

- Debt-Free or Financially Secure: If you’re debt-free and have a healthy emergency fund, you can allocate more of your income to investment and savings. You might even reduce your needs category (as they will already be covered by previous allocations) or shift more to wants.

The 50-30-20 budgeting method is a simple yet powerful tool for managing your money effectively.The 50-30-20 budgeting method is a widely used personal finance strategy that breaks down your monthly income into three simple categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This method offers an easy-to-follow structure that helps manage your finances, whether you’re looking to save, pay down debt, or manage day-to-day expenses.

Visit our other website: https://synergypublish.com