Rocket Money: The Ultimate Personal Finance App for Budgeting, Savings, and Credit Scores

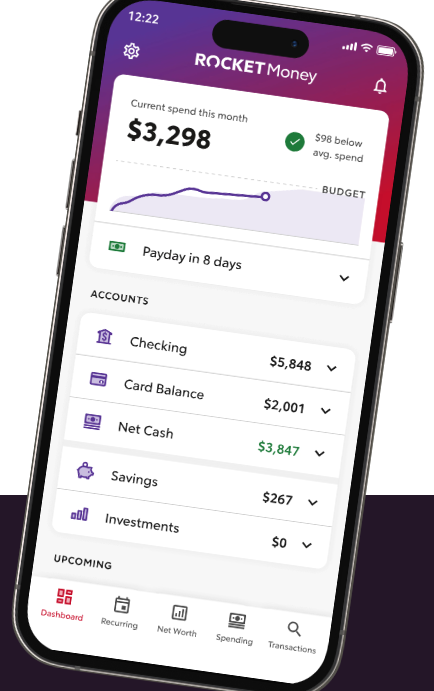

Managing your finances doesn’t have to be overwhelming or time-consuming. With Rocket Money, you have an all-in-one tool that helps with budgeting, savings, credit score monitoring, and even managing subscriptions. Whether you’re trying to save money or boost your credit score, Rocket Money simplifies the process and helps you stay on track.

In this article, we’ll explore how Rocket Money works, its key features, and why it’s becoming a must-have app for anyone serious about managing their personal finances.

What Is Rocket Money?

Rocket Money, formerly known as Truebill, is a personal finance app designed to help you take control of your finances. The app simplifies budgeting, tracks subscriptions, monitors credit scores, and even helps you reduce your bills. Available for both iOS and Android, Rocket Money integrates all the essential financial tools you need into one easy-to-use platform.

The app is backed by Rocket Companies, the financial powerhouse behind Rocket Mortgage. With this strong foundation, Rocket Money brings both innovation and trust to its users.

Rocket Money App Features

Rocket Money comes packed with various features designed to make personal finance management more accessible. Here are the key components that make it stand out:

1. Rocket Credit Scores

Your credit score is a crucial part of your financial health. Rocket Money monitors your credit score and provides tips on how to improve it. The app gives you regular updates on your credit status and offers detailed insights into the factors affecting your score. This feature helps you understand the significance of credit utilization, payment history, and credit inquiries, allowing you to make informed decisions to boost your score.

2. Rocket Savings

Saving money can be a challenge, especially when unexpected expenses arise. Rocket Money simplifies saving by helping you identify areas where you can cut back. The app also includes automated savings tools, enabling you to set aside small amounts of money regularly. Over time, these contributions add up, helping you reach your financial goals faster.

In addition to automated savings, Rocket Money offers advice on how to reduce your recurring bills. For example, it can negotiate lower rates for services like cable, internet, and phone, putting more money back in your pocket.

3. Rocket Budgeting

Budgeting is the cornerstone of any good financial plan. With Rocket Money, creating a budget is easy. The app tracks your spending in real-time, categorizing expenses so you can see exactly where your money is going. Whether it’s dining out, groceries, or utilities, you’ll get a clear picture of your spending habits.

The app allows you to set monthly spending limits for each category and alerts you when you’re approaching those limits. This proactive approach helps you stay on top of your finances and avoid overspending.

4. Rocket Visa

Rocket Money also offers the Rocket Money Visa, a reloadable card that can be used for everyday expenses. The Visa card integrates seamlessly with the Rocket Money app, allowing you to track spending in real-time. This feature is particularly helpful for those who want to stick to a budget, as it allows you to allocate funds for specific categories like groceries, dining, or entertainment.

5. Subscription Management

One of the standout features of Rocket Money is its ability to track and manage your subscriptions. The app automatically detects recurring payments for services like Netflix, Spotify, and Amazon Prime. It then gives you the option to cancel any subscriptions you’re not using, saving you money on unnecessary expenses.

6. Bill Negotiation Services

Rocket Money goes beyond just tracking your bills—it helps you lower them. The app’s bill negotiation service works by contacting your service providers and negotiating lower rates on your behalf. Whether it’s your cell phone plan, cable bill, or insurance, Rocket Money can help you reduce costs and save money over time.

7. Customer Service and Premium Chat

Premium users also benefit from concierge services, which include priority customer support through chat. Users can get financial advice or assistance with using the app, although this feature is limited for free users

ROCKET MONEY

BUSINESS INSIDER

Pricing and Plans:

Free Plan: The basic version is free and includes expense tracking, limited budgeting, and subscription tracking.

Premium Plan: Ranges from $6 to $12 per month, based on what you think is fair. It includes all advanced features like bill negotiation, credit monitoring, real-time account syncing, and concierge services

BUSINESS INSIDER

Limitations:

The free version offers limited functionality, especially for users who want comprehensive budgeting tools.

Customer support is primarily available through chat or email, with no phone option, which may be a downside for some users

BUSINESS INSIDER

Overall, Rocket Money is a solid tool for personal finance management, especially for users who want automated subscription management and bill negotiation services. However, its premium features come at a cost, and its free plan might not be as feature-rich as other budgeting apps.

Why Choose Rocket Money for Personal Finance?

With so many personal finance apps available, you might wonder what sets Rocket Money apart. Here are a few reasons why Rocket Money is becoming the go-to app for managing personal finances:

1. User-Friendly Interface

Rocket Money’s intuitive design makes it easy for users of all experience levels to navigate the app. Whether you’re new to budgeting or a seasoned pro, the app’s layout simplifies financial management, providing you with valuable insights at a glance.

2. Comprehensive Financial Tools

Rocket Money brings all the essential financial tools under one roof. Instead of juggling multiple apps for budgeting, saving, and monitoring your credit score, you can manage everything from a single platform. This integration makes it easier to track progress and stay focused on your financial goals.

3. Security and Trust

Rocket Money is backed by Rocket Companies, one of the most trusted names in financial services. The app uses bank-level security measures to protect your financial data, ensuring that your information is safe from unauthorized access.

How to Get Started with Rocket Money

Getting started with Rocket Money is straightforward. Here’s a step-by-step guide to setting up your account:

- Download the App

Rocket Money is available for download on both iOS and Android. Simply visit the App Store or Google Play, search for “Rocket Money,” and install the app. - Create an Account

Once you’ve installed the app, create a free account using your email address or sign up through your Google or Apple ID. - Link Your Bank Accounts

To fully utilize Rocket Money’s features, link your bank accounts, credit cards, and other financial accounts. This step allows the app to track your transactions and provide real-time insights into your spending habits. - Set Up Your Budget

Rocket Money will automatically categorize your expenses, but you can customize your budget categories as needed. Set spending limits for each category, and the app will alert you if you’re nearing your limit. - Track Your Progress

Over time, Rocket Money will help you track your savings, spending, and credit score. Use the app’s insights to adjust your financial habits and stay on top of your goals.

The Future of Rocket Money

As more people turn to technology to manage their finances, apps like Rocket Money are becoming indispensable. With its combination of budgeting tools, credit score monitoring, and savings features, Rocket Money is positioned to become one of the leading personal finance apps on the market.

The app operates on a freemium model, with a free basic version and a premium version that ranges between $6 to $12 per month, offering advanced features like real-time syncing, credit report access, and concierge services.

Visit our other website: https://synergypublish.com